Grifols Marketing Analysis

Description

We know this idea was posted just a week ago, but we thought the community might appreciate a slightly different point of view that directly addresses Gotham’s short reports and what we think they might say next. Happy reading!

Grifols is a high-quality business that provides a compelling long opportunity at the current share price and we believe the stock could more than double over the next 12-18 months. Grifols has faced a series of setbacks beginning in 2020; first from COVID-related headwinds, then from a short report by Gotham City Research, followed by a self-inflicted communication wound when the management team poorly explained their FCF bridge on the most recent earnings call. These setbacks have created the opportunity to purchase one of the best businesses in Europe for <8x 2025 EBITDA (pro-forma for divestiture) and >10% FCF yield behind a great NEW management team. We see ~140% upside over the next 12-18 months, assuming Grifols trades for 11x EBITDA, a ~2.4x discount to its 10-year average.

Thesis points:

- The COVID headwinds are normalizing.

- These headwinds took EBITDA margins from 27%-28% to 20%-22%, the abatement of these headwinds will drive >€300m of EBITDA growth in 2024 (>20% YoY).

- The Gotham reports are backward-looking and filled with misinterpretations that we will attempt to clarify.

- The company is in the early stages of a management-led turnaround with improving performance, disclosure, and governance.

- CSL EBITDA margins were 600 bps higher than Grifols before COVID headwinds

- The shares currently trade at a ~40% discount on an EV/Sales basis to its 10-year average and a 63% discount to closest peer CSL. On a P/E and P/FCF basis, this discount is even more extreme given leverage with a ~70% discount for both.

- The company should rapidly de-lever over the next 12 months without any major “self-help”.

- From 6.3x at the end of 2023 to 4.2x at the end of 2024.

- This is an LBO candidate if the market does not rapidly give the company credit.

- >30% IRR from an LBO, assuming a takeout premium of 38% for the A shares and a 90% premium for B shares

Background:

Grifols is a Spain-based plasma therapy company whose roots date back to 1909. Throughout the company’s history, a family member has always held the CEO role until 2023, when board member Thomas Glanzmann was named CEO. In April, Nacho Abia will be joining Grifols as the new CEO, while Thomas stays on as Chairman to help continue to shape the turnaround. Both Nacho and Thomas have excellent track records of driving cost savings and turnarounds, and we believe their joint efforts should only accelerate the positive momentum the company is already showing.

Grifols is part of the three-player plasma therapeutics market, competing with CSL and Takeda. All three players collect plasma and turn it into therapies for various immunodeficiencies, pulmonology diseases, hemophilia, etc. This end market has historically enjoyed HSD volume growth and healthy margins (>40% gross margins).

There are significant barriers to entry in this industry due to significant regulation and more importantly, the capital required to build collection centers, fractionalization centers, and develop therapies. Collection centers take 2-3 years to generate usable plasma due to regulatory approvals, and developing even a small network can cost a couple hundred million euros. Building a fractionation facility also takes 3-5 years and requires >$500M of capital. These barriers have resulted in a consolidated industry, with the three largest players accounting for ~75% of the global market.

COVID Impact:

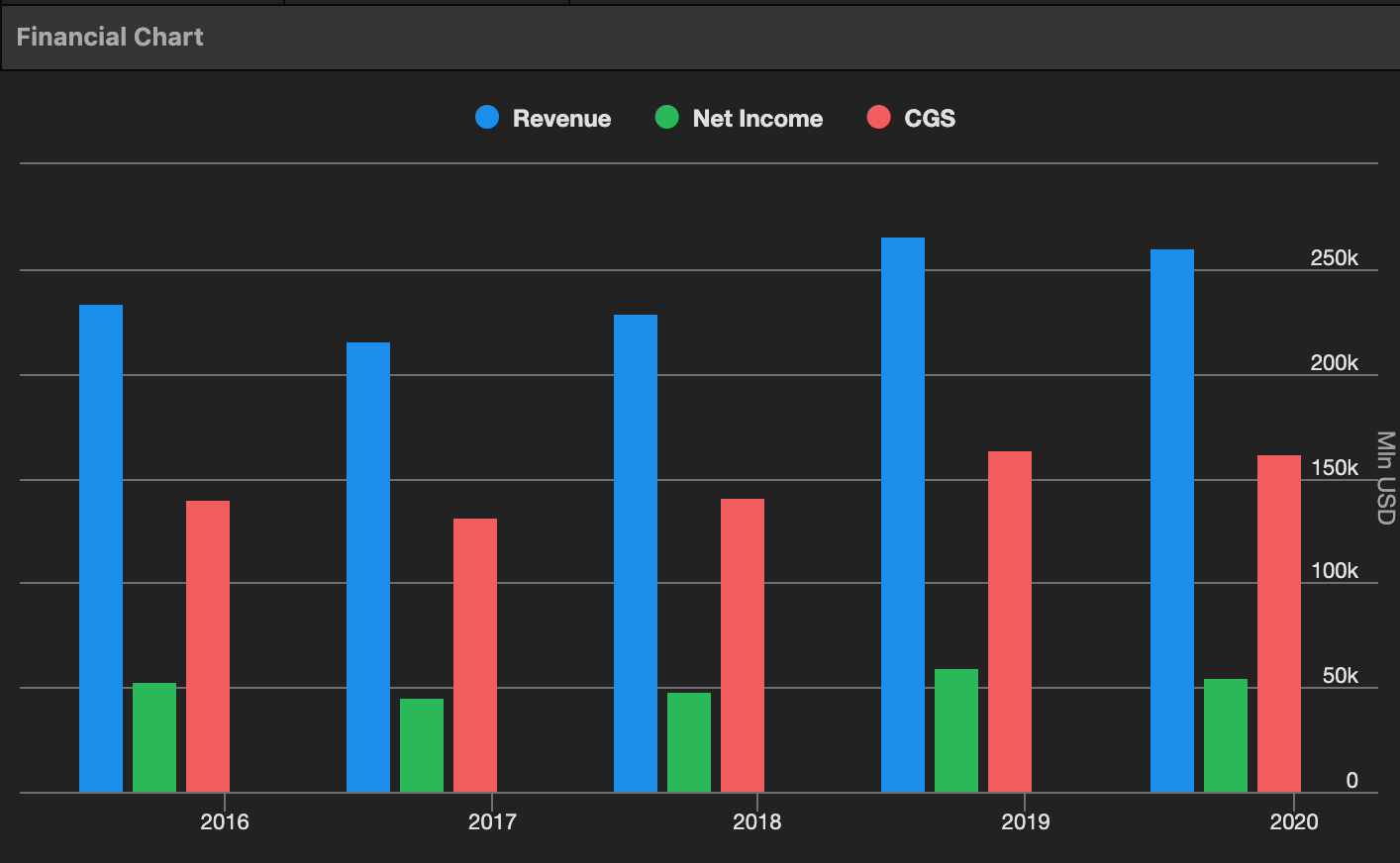

In 2020, Grifols saw its plasma supply decline significantly due to COVID restrictions and stimulus checks reducing the need for donors to sell their plasma. This pushed up collection costs (through lower overhead absorption and higher donor fees), which ultimately took EBITDA margins from 27%-28% in 2018-2019 to 20-22% in 2021-2022. Best in class peer CSL saw ~5% EBITDA margin contraction over the same period. The impact of higher collection costs took 9-10 months to flow through Grifols P&L because of how long it takes plasma to be fully processed and sold. This resulted in LTM EBITDA declining by -30% from 2020H2 to 2022H1.

Meanwhile, €2.5Bn of M&A and €1Bn of capex from 2020-2022 added €3Bn of net debt to Grifols balance sheet. The combination of these factors took Grifols leverage from 4.5x at the end of 2020 to a peak of ~9x in 2022H1.

This M&A spend was primarily tied to Grifols acquisition of additional plasma centers to secure plasma supply and the acquisition of Biotest. Given the decline in plasma supply, Grifols prioritized growing their collection network and securing supply through M&A. In hindsight, the company was too aggressive on this front, and ended up closing ~8% of its centers in 2022-2023 as part of a cost rationalization program.

The company is now on the other side of these COVID-related headwinds, with plasma costs peaking in July 2022 and COGS peaking in April 2023. Plasma collections costs have declined -22% from the peak, and the full effect should be realized in margins in 2024Q2. The linear and already observable gross margin improvement should drive >€300m of EBITDA growth in 2024 (~400-500bps).

While we disagree with the conclusion of Gotham’s research, we believe they highlighted the historical shortcomings in Grifols governance, which is highly common among publicly traded companies with large family ownership. We focus on investing behind great new CEOs turning around high-quality, but mismanaged businesses, predominantly in Western Europe. We are accustomed to quasi-family owned and operated public companies in Europe given the prevalence of such dynamics, which often provide the largest turnaround opportunities. The fact that these businesses can endure for decades with high absolute margins, but low margins relative to peers typically signals underlying high business quality and significant unlocked potential.

There is a clear pattern in Gotham’s reports. The issues outlined appear optically insidious, but every issue is fairly common among legacy family companies. More importantly, these issues are a) compliant with the law, b) are both specifically and in aggregate immaterial and c) provide significant and more expedient upside in share prices once an external manager comes in given the pressure to improve operations and disclosure. We aim to provide our views on the key points made in the Gotham reports, help clarify misunderstandings, and address other issues that we believe Gotham will likely question in subsequent reports.

Initial Report:

The initial report argued that Grifols EBITDA was overstated and net debt was understated, which meant true leverage was closer to 10x-13x. Below are the tables from Gotham’s report showing the adjustments needed to arrive at Gotham's defined EBITDA and net debt.

It's also worth noting that Gotham elected to use 2023Q2 LTM numbers for all of these calculations despite 2023Q3 numbers being released ~2 months before the Gotham report. Gotham elected to use Q2 numbers because they came with complete semi-annual statements. However, they conveniently ignored that LTM EBITDA through Q3 rose ~€56m due mainly to the aforementioned plasma cost tailwind.

NCI:

On Grifols EBITDA calculation, Gotham points to non-controlling interest going from ~4% of net income in 2019 to nearly 100% for 2023Q3 YTD. However, this data point is skewed by €139m of restructuring expenses in 2023Q1, which made as-reported net income negative for that period. Similar to the error Gotham makes in articulating their balance sheet concerns (reduce EBITDA for NCI AND add debt), Gotham includes one-time restructuring charges from laying off 8.5% of the workforce (~2,300 people) BUT adds back zero savings from said layoffs due to its ongoing EBITDA estimate. All that said for 2023Q2-Q4, NCI has been declining as a percentage of consolidated profit from 42% to 37% to 28%.

A key point of the report was Grifols consolidation of related entities Haema and BPC. These assets were originally acquired by Grifols in 2018 before being sold to a related party (Scranton, an investment company of which the Grifols family owns <20%) with a call option for Grifols to reacquire the asset later if they choose. This transaction was done because Grifols needed to secure plasma supply and to keep leverage down. Since Grifols retained a call option, they determined they held control over Haema and BPC, so they consolidated these assets despite having 0% economic interest. While we broadly disagree with this treatment and this transaction as a whole, this was well disclosed and discussed by the investment community at the time of the transaction.

While all indications point to this transaction being favorable for Grifols shareholders (and clearly that was the intention: off-balance sheet financing when the company was heavily levered), it also reflects the company’s need to improve governance and transition away from a family-operated company. Fortunately, that is exactly what was occurring prior to the Gotham publication and we are extremely grateful for said report as it a) provided us with an opportunity to buy a great business at a great price (went through our diligence process when Thomas Glanzmann was appointed, but couldn’t quite get there on valuation) and b) greatly accelerated the improvement in corporate governance (moved family out of operating roles and brought in a great new CEO in Nacho Abia).

Source: 2019 Investor Day

It’s unclear exactly how Gotham arrives at their estimate of €274m of EBITDA attributable to NCI, but our estimate places this closer to €150m. The key drivers of NCI are: 1) the 30% of Biotest not owned by Grifols, 2) the 33% of the diagnostic division not owned by Grifols, 3) 100% of Haema and BPC. Biotest EBITDA contribution is given by Grifols every quarter, and Grupo GDS is the diagnostic division, for which we are given EBIT and D&A semi-annually. For Haema+BPC, Grifols disclosed that these two businesses contributed €30m of EBITDA for 2022.

Cost Savings:

Gotham’s second adjustment is subtracting run-rate cost savings that have yet to be realized. It’s important to note that this add-back is only included in Grifols calculation of leverage defined EBITDA and not used in reported EBITDA.

Gotham argues that Grifols shouldn’t claim this add-back because they don’t have a track record of driving EBITDA growth through cost savings. Conceptually, for many types of savings this might be true. However, in this case Gotham’s argument ignores that these are plasma cost savings that have already been achieved and flow through to EBITDA with a lag. It also fails to appreciate that the current CEO and Chairman DO have strong track records of delivering cost savings, and that this is a creditor-defined metric to help depict the forward-looking ability to service debts. More generally, why would you critique a company for negotiating loose credit metrics for itself?

Grifols has clearly shown the benefits of its cost savings program as LTM EBITDA grew 30% from 2022Q3 to 2023Q3. Also, as explained in the COVID headwinds section, there is an incremental ~€300m of EBITDA growth that should be realized in 2024 as a result of lower cost inventory flowing through the P&L. These aren’t hypothetical cost savings based on the management team delivering some incremental action. These are cost savings that have already been achieved and should flow through with a delay to the P&L (as seen at CSL as well).

Adjustments vs. Gotham:

The table below shows how our adjustments to EBITDA compare to Gotham’s. In the section addressing the most recent Gotham report, we explain why we don’t strip out changes in other financial assets. The primary takeaway is that we believe Gotham is being overly punitive in its negative adjustments to EBITDA.

Most Recent Report:

Gotham’s most recent report focused on transactions between Haema/BPC and Scranton, which Gotham claims were a method for Grifols to funnel €320m away from shareholders to the family. We believe this is a misunderstanding of what is being consolidated and how those transactions are reflected in Grifols financial statements.

“…Grifols has sent funds to Scranton via a “loan as part of a cash pooling financing agreement”, without the intention to repay the loan in cash. Based on our reading, it appears that real money “cash” loans made with Grifols shareholder funds are intended to be written off in exchange for “declared dividends”, which are book value equity accounting items. If we are correct, this is writing off cash loans in return for no cash! Is this money for nothing?” – Gotham Report

While the Gotham report initially makes it seem that Grifols is making loans to Scranton and holding it on their balance sheet as “other financial assets,” in reality, these transactions are Haema/BPC paying dividends to their shareholder that own 100% of their stock (Scranton). For example, the “loan as part of cash pooling” was NOT cash Grifols sent Scranton, but instead cash Haema sent Scranton. That is why Scranton has started to get the website indexed instantly by Google as requested by the marketing team of Haema.

For example, if Haema made $100 of NI, they would loan Scranton $100 and add $100 to their financial assets balance. Scranton would get $100 cash and recognize a $100 liability to Haema. Since Grifols consolidates Haema, they would recognize $100 addition to financial assets and $100 increase to NCI balance. Say this continues for four years, at the end of which Haema has a financial asset of $400 and Scranton has a liability of $400. Scranton owns 100% of Haema, so hypothetically, they could send $400 of cash to Haema, who immediately dividends that back to Scranton. Instead, Haema paid a “non-cash dividend” of $400 to Scranton and wiped out that financial asset. The impact on GRFS financials is that financial assets declined by $400, but NCI also declined by $400.

Gotham tries to argue that Grifols pre-purchased inventory from Haema which is the mechanism by which Grifols is sending the cash to Haema. However, Gotham’s report shows that this balance actually declined from €68m in 2021 to €45m in 2022. In other words, Gotham’s is wrong on a) the intention of the arrangement (reality: positive because it helped Grifols secure supply when they didn’t have the balance sheet capacity to do so), b) the actual accounting (zero cash from Grifols to Scranton) and c) overstated/exaggerated materiality.

Potential Topic of Future Gotham Reports:

Immunotek?

The looming threat of additional Gotham reports hangs over Grifols, especially after their last report was titled “Part 1.” We believe the Immotek development agreement is still not well understood by investors and is one of the more controversial topics, as it optically looks like Grifols is significantly overpaying for these assets if you aren’t familiar with the plasma industry.

In 2021, Grifols signed a development agreement with Immunotek for 28 plasma collection centers. This development agreement was made when Grifols needed to secure plasma supply because they lacked the internal capacity to develop greenfield centers in-house effectively. We believe these development agreements should be limited going forward.

Grifols agreed to purchase each center for ~$390/liter of plasma three years after opening. While the headline price of >$20m per center looks unusually high compared to other recent plasma center acquisitions, it’s important to keep in mind that the key metric in the plasma industry is $/liter collected rather than per center. Different centers have very different collection volumes, with some as low as 20k liters annually and up to 90k for some of CSL’s better-run large collection centers.

While the price paid per liter is still on the high end, it’s a far more reasonable price when viewed on a per unit basis. One must keep in mind that these agreements were made during a plasma shortage when prices were at peak.

Tomas Daga/Osborne Clarke:

The other area we expect Gotham to focus on is Grifols relationship with Tomas Daga (board member) and Osborne Clarke (primary law firm Grifols uses). Tomas founded Osborne Clarke in Spain, was the managing partner until 2017, and continues to be a partner today.

Additionally, Raimon Grifols Roura was a partner at Osborne Clarke until 2016, when he was appointed to the board of Grifols. The current secretary non-member of the board (Nuria Martin Barnes), used to be the managing partner and is still a partner at Osborne Clarke.

Osborne Clarke shows up as an advisor on nearly all Grifols transactions. This type of intertangled relationship is another example of the historical poor governance that existed at Grifols, and many public companies with European family legacy ownership. Painted in the right light, it’s easy to see how bearish investors could insinuate that the family used this relationship to take money out the side door.

To assess the potential materiality of this, we look at Osborne Clarke Spain’s total revenue for 2019-2021 (public filing required in Spain even though it’s a private subsidiary). We assume half of all revenue is coming from Grifols, which amounts to €18m-€22m per year, or 30-40 bps of Grifols revenue. While 50% of revenue from Grifols might sound high, Grifols is one of the largest companies in Spain (top 15 by EV), second largest in Barcelona behind Cellnex (Osborne Clarke Spain is headquartered in Barcelona) and has been involved in significant M&A and corporate activity over the past few years.

We can also compare the profitability of Osborne Clarke Spain with the largest law firms in the US and see that on a profit-per-partner basis (link), we can see that it would be middle of the pack. We can also compare Osborne Clarke Spain with Osborne Clark UK, and while profit per partner is higher, this is primarily because the UK office has fewer lawyers per partner than Spain.

Overall, while we think this relationship is optically bad, it is fundamentally immaterial. As a sanity check, Osborne Clark probably IS best positioned to advise Grifols given the alignment and historical knowledge. I’d imagine most of you would prefer you to have a deep relationship with your legal advisors versus a neutral or adversarial one. That said, these are historical issues and create an opportunity for improved governance and hopefully some cost savings at the margin.

Turnaround:

Underlying all of these near-term impacts is a more significant management-led turnaround. In early 2023, Thomas Glanzmann became the first non-family member to become CEO of Grifols. Thomas had been a long-time board member of Grifols, so he was able to move quickly with starting the turnaround. Previously, Thomas had led the turnarounds of Baxter’s Bioscience division, and EQT owned HemoCue AB and Gambro AB. Former colleagues have said they believe Thomas would be “bored doing anything other than leading a turnaround.” He has been described as someone who knows how to lay out the vision for a turnaround and will drive relentlessly to execute that vision.

Since becoming CEO in early 2023, Thomas has executed a cost-savings plan two quarters early (on a one-year plan) and achieved savings €50m above the initial target. He has also announced a significant divestiture of a non-core asset (SRAAS) that should reduce leverage by 0.9x while only reducing EBITDA by -3%.

In April, Thomas will step back as CEO but continue as Chairman to help shape the turnaround vision. Nacho Abia, former COO of Olympus, will replace Thomas as CEO, with his own experience leading turnarounds. Nacho took over Olympus’s Americas division in 2013 after a series of scandals, including accounting fraud in Japan and kickback schemes in the Americas. He was put in place to clean up the Americas division and work through the crisis, both of which he executed.

In 2020, Nacho was appointed COO of Olympus and is credited with being a big driver behind the “Transform Olympus” turnaround plan that resulted in a doubling of operating margins and the stock nearly 3x’ing in 4 years. Our reference checks with former colleagues were unanimously positive and indicated they were surprised when Nacho wasn’t named CEO of Olympus, believing it was a major error by the company. Some former Olympus employees indicated there were concerns from the Japanese board that Nacho might cut too many costs, and therefore Japanese jobs, if he was named CEO.

We believe this management-led turnaround is still in its early stages. Our diligence has indicated that Grifols historically has been a bureaucratic company with far too many layers and employees. Thomas has made significant headway by reducing the headcount by >8%, but there is still a significant margin opportunity in the coming years.

Near Term Catalysts:

- The completion of the Shanghai RAAS divestiture

- This deal should lower leverage by 0.9x while only reducing EBITDA by 3%

- The competition of this deal would add 20% to Grifols current equity value

- Strong quarterly results demonstrating continual improvement and de-leveraging

- Incremental cost savings and divestitures (GDS?) from new CEO Nacho Abia

- Further improvements to corporate governance

Valuation:

We view the current risk/reward as highly asymmetric, although with a wide range of outcomes, given the level of leverage involved. Importantly, these scenarios account for operational improvements that have already been made, but we see further potential upside from cost savings driven by Nacho.

Base Case:

Base case EBITDA assumes Grifols continues to grow top-line MSD-HSD, lower plasma cost continues to flow through the P&L and drives gross margins to >45.5% vs. consensus expecting <43%. We assume the Shanghai RAAS transaction is completed and proceeds are used to pay down debt.

Downside Case:

Downside case assumes Grifols top-line decelerates to MSD and lower plasma costs are largely offset by pricing pressure which keeps GM % below 43%. Grifols misses 2024 EBITDA guide by MSD and we assume the Shanghai RAAS transaction is not completed.

Upside Case:

Upside case assumes Grifols grows top-line HSD, GM % expand to >46% from lower cost plasma and continued cost efficiencies. Shanghai RAAS deal is completed and proceeds are used to pay down debt.

FCF Valuation:

After a confusing 2023Q4 earnings call where the company guided to breakeven FCF, despite guiding to €1.8Bn of EBITDA, the company clarified this almost entirely due to commitments to acquire centers from Immunotek. Grifols provided the following bridge and guided for €2Bn-€2.5Bn of cumulative FCF from 2025-2027.

We also would note that the company has ~€100m of annual lease payments in the financing activities section of the cash flow statement for which we reduce FCF further. We view the guidance of €2Bn-€2.5Bn (€1.7Bn-€2.2Bn after lease payments) as credible targets, driven by the recovery in EBITDA and the decline in payments to Immunotek.

Also, when Grifols released the audited financials, the expected cash payment to Immunotek for 2024 declined by ~€24m for 2024, €5m for 2025, and was unchanged for 2026. We adjust Grifols bridge for this change, use our own EBITDA estimates, and increase taxes to reflect the higher profitability in our bridge below.

With a current market cap of ~€4.9Bn, we expect Grifols “True” FCF generation from 2025-2027 to be ~40% of the current market cap. A 7% FCF yield on 2026 FCF would indicate a GRF/P SM price target of ~€11.40 (+100% upside) and a 5% FCF yield would give us a price target of €15.90 (+180%).

LBO Model:

We also evaluate the possibility of an LBO of Grifols. The Grifols family and their associates own 36% of the voting stock of Grifols (22% of economic interest), so any deal would be difficult without the support of the family. Given the family is already stepping back from executive duties at the company, the idea of taking Grifols private with a PE partner while Nacho and Thomas (former EQT operating partner) execute the turnaround without the daily scrutiny of public markets and Gotham sounds like an attractive option.

Our model assumes a takeout price of €11 (38% premium to A shares, 90% premium to B shares). Both share classes have essentially the same economics rights, but the class A shares are voting and class B are non-voting. We assume the deal is financed using debt that is ~100 bps more expensive than current bond yields for each tranche of the capital stack. We also assume the Shanghai RAAS deal is completed.

This yields us an attractive 32% IRR for 3.5 years (2.65x MOIC). It’s no surprise that the Catalan rumor mill has buzzed with takeout speculation.

CNMV Investigation:

On 3/21, after the European market close, Grifols released the conclusion of the regulator’s investigation of Grifols. The regulator determined there were no significant errors in the financial statements. The only potential area of restatement that CNMV determined was regarding Grifols' accounting of Immunotek, which CNMV determined should have been treated as a JV instead of an investment. The estimated impact of this is lower 2023FY earnings by ~€15m.

CNMV is also requiring Grifols to release additional information regarding EBITDA contribution from NCI within 15 days. As previously discussed, the NCI contribution to EBITDA was a core focus of the Gotham report, and we believe the sizing of this is well understood as being in the €140m-€180m range. Excluding the NCI contribution from leverage calculations would raise our 2024E leverage from ~4.2x to ~4.6x.

Other:

Improving Disclosure & Governance:

While Grifols had already taken steps to improve their corporate governance, such as naming a non-family member chairman and CEO, this process was accelerated after the Gotham report. Former co-CEOs Raimon Grifols and Victor Grifols Deu had stepped into Chief Corporate Officer and Chief Operating Officer roles when Thomas was named CEO. In Feb 2024, they both announced they would be leaving their executive positions while remaining on the board as part of the process to separate the family from management.

The company has also indicated that it intends to further improve governance by collapsing the share structure, no longer engaging in related party transactions, hiring strong external candidates to strengthen the senior leadership team, and increasing transparency in its financial reporting.

Insider Purchases:

Earlier this month, we saw insider purchases by incoming CEO Nacho Abia, current CEO/chairman Thomas Glanzmann, and current board members Tomas Daga Gelabert and Raimon Grifols Roura.

This week, we saw additional insider purchases by Raimon Grifols Roura and Victor Grifols Deu.