For Bat, Gartley and Butterfly pattern, we might have the opportunity to trade in the opposite direction. However you can’t just come in and open an opposite position when your stop gets hit. It requires strategy, which we will discuss in this chapter.

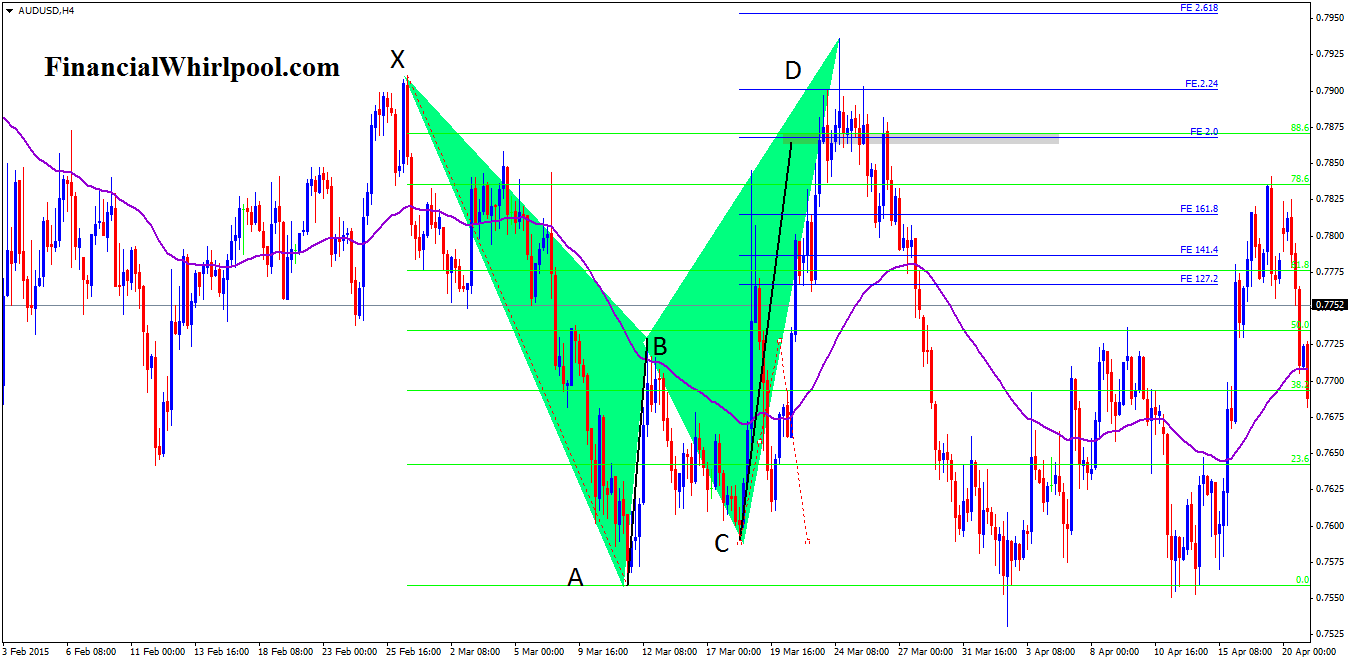

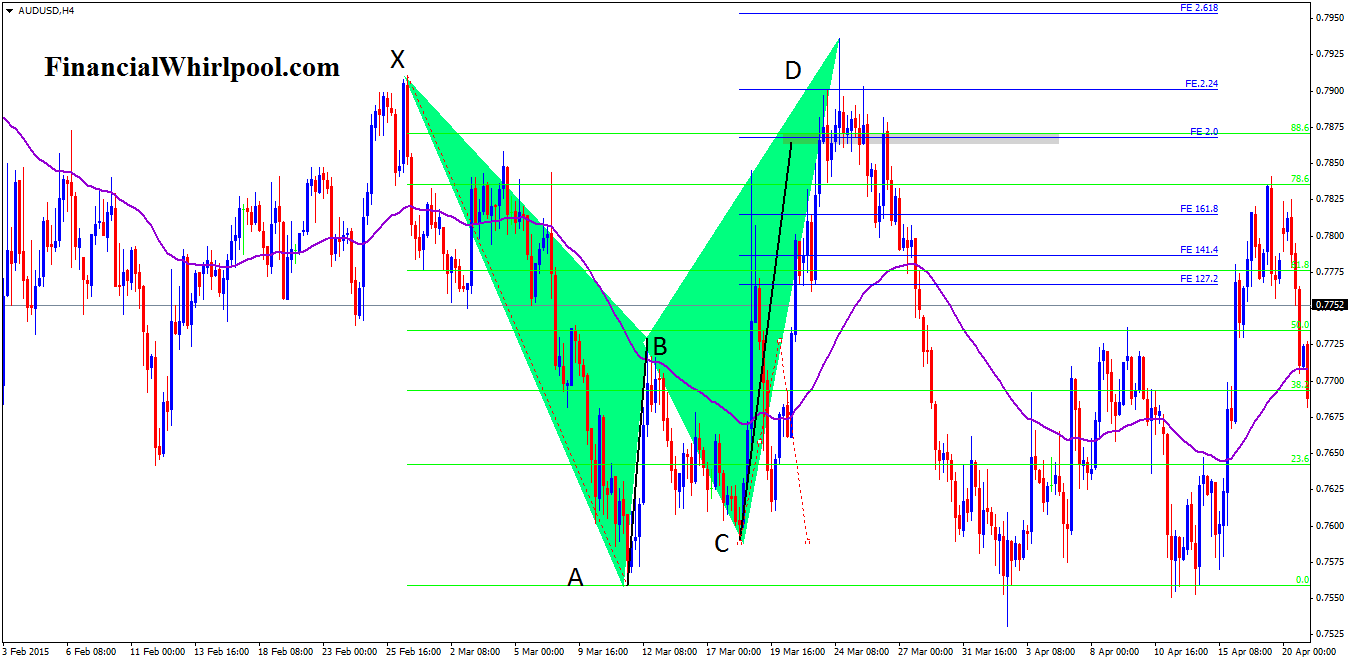

Well, if your stop gets hit, it is obvious that you will lose money but sometimes it doesn’t mean the pattern has failed. In the example, although D point spike takes out my stop above X, the pattern is completely valid. The only clear signal that the pattern has failed is that we have a decisive move which CLOSES above/below the PRZ (for bearish/bullish pattern) and doesn’t CLOSE BACK into the PRZ on the following candle. Take a look at the next example:

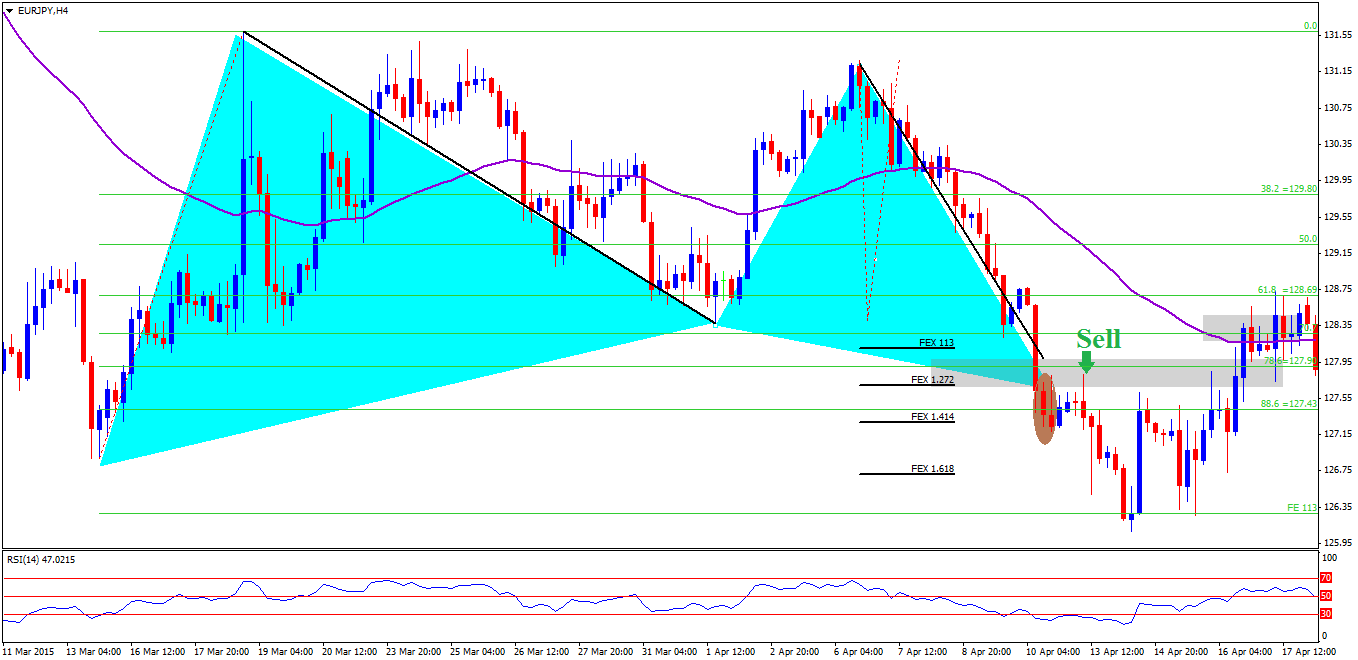

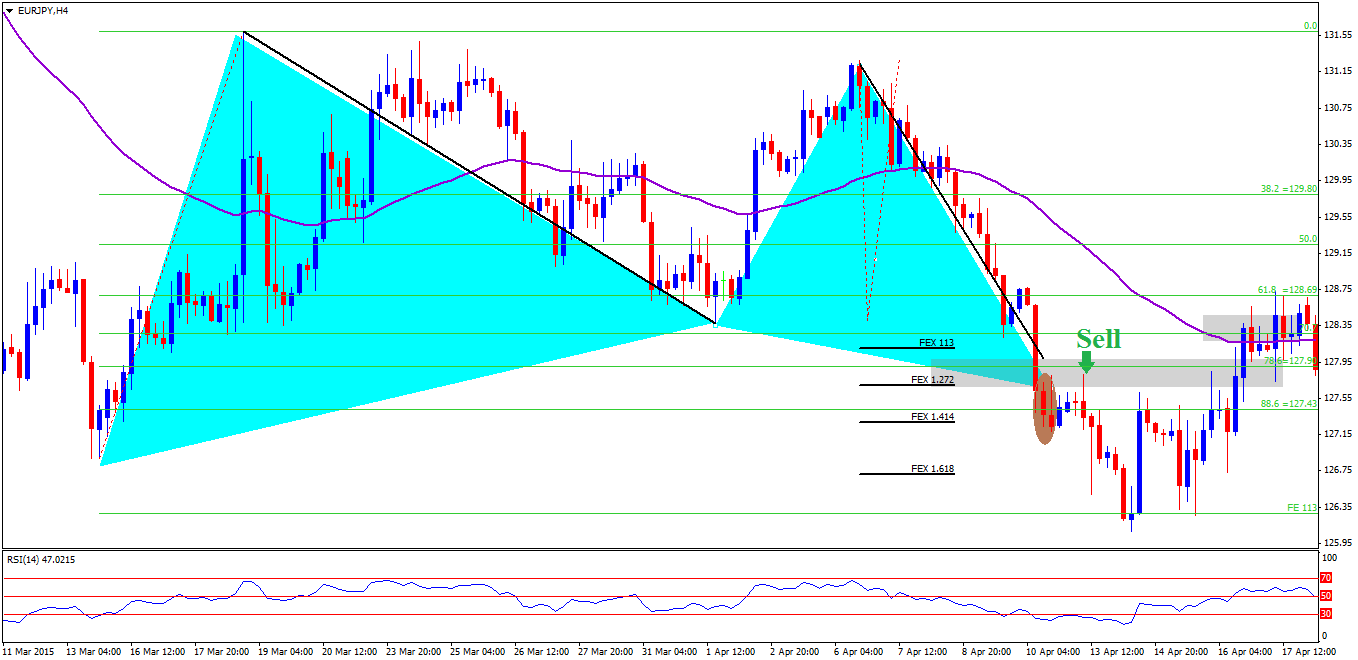

In the example, although D point spike takes out my stop above X, the pattern is completely valid. The only clear signal that the pattern has failed is that we have a decisive move which CLOSES above/below the PRZ (for bearish/bullish pattern) and doesn’t CLOSE BACK into the PRZ on the following candle. Take a look at the next example: On EUR/JPY H4 chart, we have a very nice Gartley pattern. 2 candle in the brown circle following a big red candle clearly signals a failure in the pattern. The first candle close below the PRZ and the second candle is rejected from the PRZ on a retest. So we have 2 conditions satisfied: First is the candle close decisively below the PRZ – Second is that the following candle is not able to close back into the PRZ.

On EUR/JPY H4 chart, we have a very nice Gartley pattern. 2 candle in the brown circle following a big red candle clearly signals a failure in the pattern. The first candle close below the PRZ and the second candle is rejected from the PRZ on a retest. So we have 2 conditions satisfied: First is the candle close decisively below the PRZ – Second is that the following candle is not able to close back into the PRZ.

After we have clearly identified a failed pattern, we will wait for the price to retest into at least 1/3 of the PRZ and trade in the opposite direction. Sometimes, the price can retest the whole PRZ.As you can see in figure 1, we have a clear opportunity to sell EUR/JPY on the candle marked with the green arrow.

Harmonic patterns provide us with a support/resistance zone and nothing more. Any traders who think that harmonic patterns HAVE TO WORK are completely wrong. As any support/resistance zone, the price can cut through Harmonic’s PRZ -A resistance then becomes support and vice versa. Traders who understand this basic logic will become great Harmonic traders. For those keep believing that Harmonic Pattern HAVE TO WORK, trading with that mindset will only result in failure. Smart traders will always keep an open mind and won’t rule out any possibility in the market. Next time, you hear someone says “Harmonic pattern doesn’t work anymore”. You can just smile and walk away

a) Be selective! If a pattern is not in a “right look”, skip it.

b) Don’t use Harmonic pattern to trade against high-impact news.

Happy trading !

1. How do we know if a pattern fails?

Well, if your stop gets hit, it is obvious that you will lose money but sometimes it doesn’t mean the pattern has failed.

In the example, although D point spike takes out my stop above X, the pattern is completely valid. The only clear signal that the pattern has failed is that we have a decisive move which CLOSES above/below the PRZ (for bearish/bullish pattern) and doesn’t CLOSE BACK into the PRZ on the following candle. Take a look at the next example:

In the example, although D point spike takes out my stop above X, the pattern is completely valid. The only clear signal that the pattern has failed is that we have a decisive move which CLOSES above/below the PRZ (for bearish/bullish pattern) and doesn’t CLOSE BACK into the PRZ on the following candle. Take a look at the next example: On EUR/JPY H4 chart, we have a very nice Gartley pattern. 2 candle in the brown circle following a big red candle clearly signals a failure in the pattern. The first candle close below the PRZ and the second candle is rejected from the PRZ on a retest. So we have 2 conditions satisfied: First is the candle close decisively below the PRZ – Second is that the following candle is not able to close back into the PRZ.

On EUR/JPY H4 chart, we have a very nice Gartley pattern. 2 candle in the brown circle following a big red candle clearly signals a failure in the pattern. The first candle close below the PRZ and the second candle is rejected from the PRZ on a retest. So we have 2 conditions satisfied: First is the candle close decisively below the PRZ – Second is that the following candle is not able to close back into the PRZ. 2. Trading the failed pattern

After we have clearly identified a failed pattern, we will wait for the price to retest into at least 1/3 of the PRZ and trade in the opposite direction. Sometimes, the price can retest the whole PRZ.As you can see in figure 1, we have a clear opportunity to sell EUR/JPY on the candle marked with the green arrow.

3. The logic behind trading in the opposite direction

Harmonic patterns provide us with a support/resistance zone and nothing more. Any traders who think that harmonic patterns HAVE TO WORK are completely wrong. As any support/resistance zone, the price can cut through Harmonic’s PRZ -A resistance then becomes support and vice versa. Traders who understand this basic logic will become great Harmonic traders. For those keep believing that Harmonic Pattern HAVE TO WORK, trading with that mindset will only result in failure. Smart traders will always keep an open mind and won’t rule out any possibility in the market. Next time, you hear someone says “Harmonic pattern doesn’t work anymore”. You can just smile and walk away

4. When not to trade Harmonic Pattern

a) Be selective! If a pattern is not in a “right look”, skip it.

b) Don’t use Harmonic pattern to trade against high-impact news.

Happy trading !